BLOG

Software Maintenance Annual Increase: Cost-Reduction Best Practices

Procurement organizations have the opportunity to drive maximum value for almost every budget dollar spent in an enterprise. And in some cases – like a software maintenance annual increase – procurement’s actions (or inactions) can impact the financials for many years to come.

Most procurement organizations are measured by a series of KPIs, one of which is savings. Savings goals for procurement are quantified in two ways. The first is hard savings or a tangible reduction from the prior year’s fees that will apply to the current balance sheet. The second is cost avoidance.

Procurement organizations tackle their savings goals with vigor – they are tangible contributions to the balance sheet. Because it’s not captured on the P&L, many enterprises fail to apply the same rigor and focus on cost avoidance, which can have huge financial impacts for organizations in future years. This is especially true in IT, particularly as it relates to software maintenance.

Understanding the Math (and Margin) of a Software Maintenance Annual Increase

Software maintenance, while declining in frequency due to migration to the cloud and subscription-based pricing models, still continues to comprise a material amount of spend for the typical large enterprise. It’s usually paid on an annual basis, and will increase approximately 3 to 10% each year.

Software maintenance provides significant profitability to vendors as the margins are extremely high.

Vendors will often negotiate annual software maintenance fee increases. These negotiated values can have significant impacts to the bottom line over time.

Here’s An Example

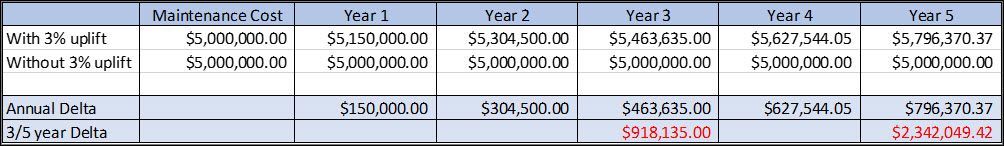

Assume an annual maintenance of $5,000,000 with a 3% uplift. This means that in Year 1, the customer’s maintenance cost will increase $150,000 over the prior year, then 3% again the following year and so on. But what happens when the vendor agrees to remove the uplift? The following is a renewal scenario where the uplift is removed for 3 to 5 years vs. paying the uplift.

While this cost avoidance isn’t visible as compared to what was paid last year, it is certainly significant from a future balance sheet perspective. After three years, the renewal costs $918,135 more than if the uplift was removed. After five years, the total delta would be $2,342,049. More specifically – the contracted renewal amount in year five will have increased by $796,370 as compared to year one.

This is an example of how IT vendors take advantage of shortsightedness to build in extra revenue year over year. While not all software vendors behave exactly this way, many do fall into some form of this example. Every year the required budget increases just to keep up with the status quo from the previous year. The chart above illustrates how important it is not only to perform price benchmark analysis on IT maintenance spend to understand what you should be paying and to learn how to protect against or minimize future increases, but also to make sure IT buyers are operating with an eye to long-term cost controls.

Hard-dollar cost reduction is a critically important KPI for IT sourcing and procurement organizations. However, attention to the soft savings can pivot also impact your future bottom line significantly.