Something has been amiss in the enterprise PC market – specifically PC pricing. Over the last three years, NPI has noticed that end-user laptops/desktops are getting noticeably more expensive. What started out as a nascent trend has become a recurring theme in the PC purchase transactions NPI analyzes for our clients. Our research team recently spent time digging into PC vendor financial disclosures, which offered some validation: margins on PCs are way up year over year.

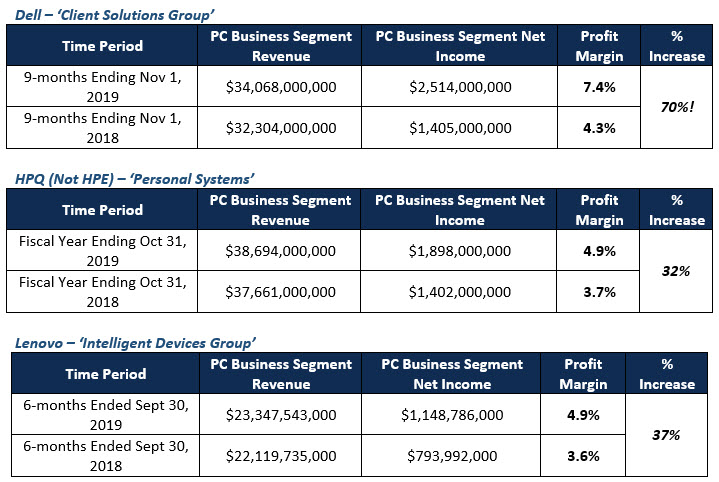

We should point out that PC OEMs ‘bundle’ their financial information in various ways that can make granular analysis difficult. NPI worked to normalize business segments in order to analyze the market for accurate trends. Even though these numbers include a wide range of PC equipment and accessories, NPI believes this represents a fair interpretation of data that clearly shows a nearly 30% to 70% increase in estimated PC margins.

Let’s take a look at three of the biggest PC makers:

4 Factors Driving the PC Pricing Increase

These increases – particularly Dell’s – are in line with similar increases NPI has witnessed vendors attempting to pass to customers. So, what’s behind the jump in PC pricing?

We believe there are four factors helping vendors drive higher pricing:

Big jump in power with new CPUs

Intel’s 10th gen chipsets represent one of the biggest gains in compute power between releases. AMD’s newest chipsets shared a similar power rise.Non-Volatile Memory (NVMe) SSDs

NPI found in many cases NVMe drives were the sole justification for significant upticks in costs for PCs that often exceeded 30% increases.Expanded RAM Requirements

Enterprise IT continues expand RAM requirements to keep up with modern applications. While it feels like 8GB was the common RAM config for business standard models not long ago, 16GB purchases are increasingly the norm, with 32GB configs beginning to pop up as spec minimums for laptops and workstations in certain cases.New Display Standards Including Multitouch Screens

Similar to trends with system memory, standard 1080p displays are already giving way to 1440p options, and the prevalence of multitouch displays in business standard configs across different industries is surprising. Also surprising is that we’re seeing minimal difference in costs for the same model with a touch or non-touch 1080p screen.

Over the last several months, NPI has seen vendor sales teams consistently use these four areas as justifications for pricing upticks. But are they justification enough? Our data and research says no. Keep in mind the component cost of PCs has risen in the last few months, but not to the extent that end-user pricing has outpaced the OEM’s costs.

Enterprise overspending on PC purchases is rising steadily, and that should be a concern for any business looking to refresh. If you’re planning a PC refresh, it’s imperative to perform IT price benchmark analysis on all vendor quotes, and to separate the analysis of core PC unit costs from the analysis of peripherals like monitors or docking stations.

RELATED CONTENT

- Blog: 4 Ways Vendors Add Mystery (and Margin) to Their Pricing

- Blog: The Art and Science of IT Purchase Negotiations

- Webinar: IT Sourcing Best Practices: Price Benchmarking, License Optimization and More

- NPI Service: IT Price Benchmark Analysis & Negotiation Intel

- NPI Service: Services Overview