SmartSpend Bulletin™

5 Microsoft Enterprise Agreement Renewal Tips for Cost Savings

Changes in the current business climate combined with Microsoft’s mission to move enterprises to the cloud is altering how it does business with its largest customers. Companies that plan to renew their Enterprise Agreements, or purchase the vendor’s offerings for the first time, can leverage the forces driving Microsoft’s behavior at the negotiation table.

Microsoft’s transformation from an on-premise software giant to a cloud leader has been nothing short of impressive over the last several years. The company’s perseverance and focus have been rewarded by soaring quarterly profits and stock prices, and a successful reorganization of its business.

While the vendor is committing its most powerful R&D, sales and marketing resources to the cloud, some Microsoft enterprise customers are still operationally and contractually locked into on-premise implementations. This has prompted the vendor to take aggressive measures to migrate these customers to the cloud. Outcomes include several pricing and licensing changes, a spike in formal and informal license audits (often disguised as Software Asset Management engagements), and increased contractual complexity and inflexibility.

The Microsoft Enterprise Agreement has always been a potential hotspot for overspending – and that is truer than ever today. The sheer volume of subscription and licensing choices for Microsoft’s offerings are overwhelming. Microsoft Enterprise Agreement renewals and first-time negotiations have never been more complex. And a volatile business climate has added new fiscal pressure to both customers and Microsoft.

There are an increasing number of license and subscription optimizationchallenges to navigate when doing business with Microsoft, as well as new cost, flexibility and licensing/subscription opportunities on which to capitalize. As Microsoft continues its metamorphosis and enterprises’ budgetary and usage requirements rapidly evolve, customers should prepare for a more challenging sourcing and vendor management environment.

While the vendor’s cloud-based offerings may be the future of its enterprise business, most Microsoft customers are still operationally and contractually locked into on-premise deployments.

MICROSOFT ENTERPRISE AGREEMENT RENEWAL: WHAT'S DRIVING MICROSOFT'S FRAME OF MIND

The conditions that have precipitated more aggressive contract negotiation behavior from Microsoft are varied. NPI has identified the following five factors:

- Pressure to move customers to subscription-based offerings. Microsoft is on a mission to move its enterprise customer base away from traditional on-premise software to its subscription-based cloud services. Revenues for its commercial cloud offerings are experiencing substantial growth, while traditional software revenues decline and the mixture strains Microsoft’s ability to support a multifaceted business. Microsoft’s success is being judged on how well it achieves this mission, and customers will find themselves under greater pressure to move to the cloud or pay the price via more contractual and pricing complexity for on-premise solutions. Most customers have made the leap to 365 and are at least experimenting with Azure. The good news is the deal window is still open for any new cloud spend with Microsoft.

- Pressure to stick to standard pricing, terms and licensing practices. Microsoft has a very structured hierarchy for approving deviations from standard pricing, terms and licensing. Sales reps and account managers have little influence in the matter, and decisions are ultimately made at the licensing desk where customer relationships and requirements have little bearing. Microsoft aims to further standardize these practices, most obviously noted when the vendor released its Online Service Terms – a single, standard set of terms that replaces its multiple Product Use Rights documents for online services. While Microsoft touts the benefits of a more centralized and simplified approach to contractual documentation, the reality is that these measures are making it more difficult for customers to receive concessions from Microsoft based on their unique user environment.

- Pressure on sales reps and channel partners to forecast revenues accurately. Microsoft is putting unprecedented pressure on its sales teams and channel partners to improve revenue forecasting and enforce on-time renewals. In fact, sales commissions and fees paid to resellers are negatively impacted when EAs are not renewed on time.

- Pressure to manage contractual and licensing resources against quarterly and annual pipeline. As a public company, Microsoft is tasked with accurately predicting revenues. To do so, the company must have clear visibility into their selling pipeline and be able to close purchases and renewals faster and earlier in quarterly sales cycle. There are a limited number of legal and licensing desk resources available to process these transactions, and it is nearly impossible to process paperwork less than two weeks prior to a calendar year, fiscal year, or quarter end. Handling these peaks in deal volume is a challenge for Microsoft’s enterprise business and delays in this pipeline can have a domino effect on quarterly and annual revenues, stock price and overall market perception.Customers need to leverage the vendor’s desire to prevent spillover and leverage purchases and renewal timing accordingly. Contrary to common wisdom, Microsoft may be more flexible in negotiations outside of their peak sourcing times.

- Pressure to reduce quarterly revenue disparity. Across NPI’s client base, more than 40 percent of Microsoft Enterprise Agreement renewals occur in Q4 of Microsoft’s fiscal year (i.e., April/May/ June). This contrasts with Q1, which typically accounts for less than 20 percent of EA renewals. This creates lumpy demand for licensing and legal resources, lumpy forecasting risk and lumpy cash flow. One of the objectives of moving to subscription based licensing is to smooth this pattern.

NEGOTIATION MISTAKES TO AVOID

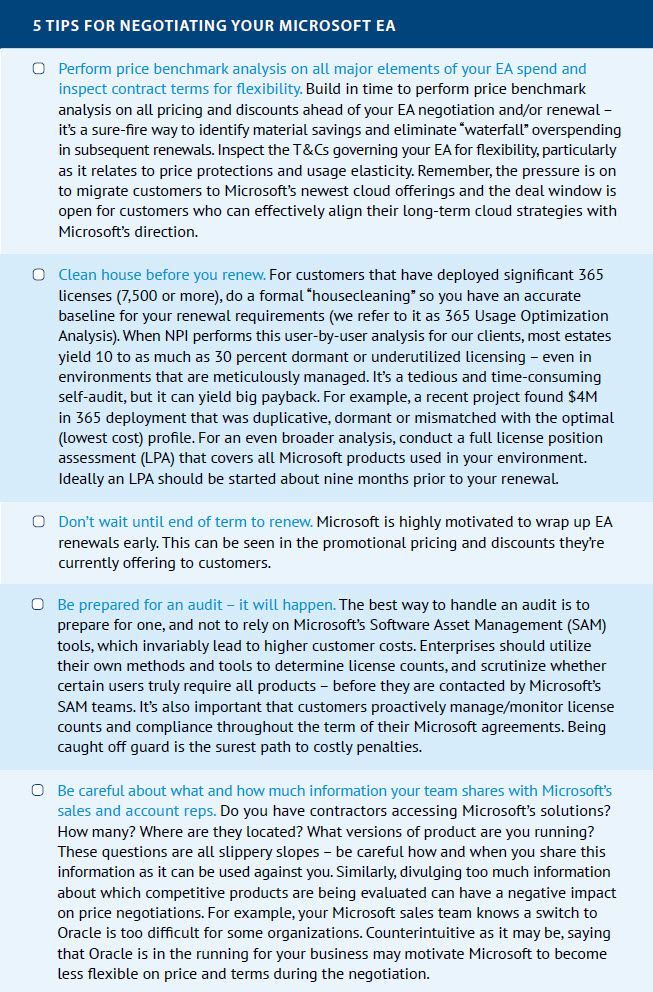

The factors previously discussed have introduced new dynamics to the Microsoft EA negotiation. They’ve also exposed new pitfalls that can lead to higher costs and less contract flexibility. Potential mistakes to be avoided include the following:

- Waiting until the last minute to renew. In the past, Microsoft customers have gained negotiation leverage by waiting until the very end of their EA term to renew, especially if this timing coincided with Microsoft’s quarter or fiscal year-end. This is no longer the case – especially for fiscal year (June), calendar year and quarter end purchases and renewals, when volume chokes the system. Microsoft is going to great lengths to get customers to renew much earlier in the quarter, including offering better pricing and discounts or allowing clients to adjust contract dates. Customers need to know how they can leverage deal timing to get more favorable concessions and greater flexibility.

- Failure to rationalize and optimize discounts. Microsoft’s “best-offer” discounts are rarely best-in-class. The difference between the discount one customer receives and what another customer with similar requirements receives can be substantial. When a subpar discount becomes the foundation for future EA renewals, overspending grows exponentially. Customers should perform price benchmark analysis on all facets of their Microsoft estate to validate they are getting a fair deal and ensure they pay a price that’s at or better than market.

- Over-focusing on pricing and under-focusing on programs and terms. Having visibility into what constitutes a fair price for Microsoft’s offerings is the first step in reducing EA costs. But it is only half the battle. To effectively lower costs, customers must understand how their unique business requirements align with standardized terms (especially for cloud offerings), the dozens of licensing/subscription permutations and the options available to them. With more options available, it is important for customers to understand which licensing and subscription programs best support their technology, business and cost management requirements; and the compliance and cost details surrounding migration from current states to future states. Furthermore, companies must understand where Microsoft is willing to be flexible as it relates to terms governing price protection and usage elasticity – particularly amid economic volatility – and negotiate those terms into their EA accordingly.

- Believing that Microsoft EA negotiations are a one-time event. Most companies view the Microsoft EA renewal as a single event. They deploy their brightest IT and sourcing resources to handle the EA, but once it is signed, these resources are effectively “off the case.” This is a mistake. Before the ink is dry on a renewal, Microsoft’s account team is working on the next one. Informally referred to as “T minus 36” (a three-year countdown until customer renews again), Microsoft follows a cyclical and successful methodology for ensuring each customer expands their Microsoft estate and spend at the next renewal event. For example, once the EA is purchased/renewed, companies must be prepared for the next event – the true-up. Following the true-up is auditing, which has become very common for Microsoft customers. Customers that have not recently been through an audit should expect to undergo one in the near term. In most cases, this will drive another round of negotiations which will require skillful interpretation of licensing programs, terms, and conditions.

- Relying on your reseller (LAR/LSP) or account rep to optimize your licensing/subscription. There are a variety of ways to license and/or subscribe to Microsoft products. A particular enterprise’s Licensing Solutions Provider or account rep may not be well versed in all the options available. However, they are well trained (and motivated by incentive) to take customers down a path to higher licensing costs. Be sure to question Microsoft’s licensing specialists on how to better structure licensing for lower spend and consider getting unbiased expertise to assist the sourcing team with vetting the recommendations.

Download the SmartSpend Bulletin™

Share This Bulletin

Interested in Learning

More About NPI's Services?

Microsoft customers have gained leverage in the past by waiting until the very end of their EA term to renew. This is no longer the best tactic.

Clean house before you renew. It’s not uncommon for a material portion of licenses and/or subscriptions to be dormant or underutilized – even in environments that are meticulously managed.

About NPI

NPI is a premier provider of data-driven intelligence and tech-enabled services designed specifically to assist large enterprises with IT procurement cost optimization. NPI delivers transaction-level price benchmark analysis, license and service optimization analysis, and vendor-specific negotiation intel that enables IT buying teams to drive material savings and measurable ROI. NPI analyzes billions of dollars in spend each year for clients spanning all industries that invest heavily in IT. NPI also offers software license audit and telecom carrier agreement optimization services.

NPI Vantage™ Pro is the newest addition to NPI’s solution portfolio – a platform developed specifically for IT Procurement Professionals to help them manage growing renewal portfolios, prepare for negotiations, and achieve world-class purchase outcomes. For more information, visit www.npifinancial.com and follow on LinkedIn.