In 2022, NPI analyzed over $25 billion in IT purchases made by large enterprises. What does that data tell us about where we’re heading in 2023? Economically speaking, the trend of volatility that shaped much of 2022 is still defining the market as we enter the second quarter of 2023. During this time, most enterprise IT leaders have enacted a more conservative approach to IT spend management. It is important to note that “conservative” does not necessarily mean “reduced spend” – it means a more rigorous approach to how the spend is vetted, approved, and managed.

Understanding where our clients are spending and saving in this type of business climate informs how we can help them as market conditions persist. Below are some data points that may be useful to enterprise IT procurement practitioners as they navigate not only a disruptive economic climate but an IT landscape that is changing faster than many of us anticipated heading into 2023 (hello, AI!).

Fewer IT Deals are Priced Within Fair Market Value Range

In 2022, only 11% of the deals NPI analyzed were determined to be priced at fair market value compared to 13% in 2021 and 15% in 2020. This trend isn’t surprising – the percentage of fairly-priced IT deals has been on the decline for some time. But it does speak to a larger issue in 2023. Market conditions, consolidation, and the AI race will force IT vendors to be more aggressive in their pricing and revenue tactics. These vendors are fighting harder than ever for margins that will neutralize any pullback or increased oversight of IT spend as the economy tightens.

More Enterprise Spend is Undergoing IT Price Benchmark Analysis

NPI analyzed over $25 billion in IT spend in 2022. The majority of NPI’s clients haven’t enacted major IT spending cuts despite market volatility. However, they are taking a more cautious and thorough approach to ensuring they achieve a world-class outcome on every IT purchase and renewal negotiation. Our clients are submitting more of their enterprise IT spend for IT price benchmark analysis, and performing IT contract and license optimization on more of their enterprise agreements. Which brings us to the next point…

Deal Savings Remains Strong

For the 87% of purchases that were above fair market value, savings potential ranged from 3% to 50% – and a few outliers were even higher than 50%. These are material, high-impact savings that can be repurposed to fund digital initiatives or sent to the bottom line (the former is more typical for our clients).

Here are some sample savings:

- IBM: $7.9M

- HCL: $17.5M

- Rackspace: $8.5M

- AWS: $7.9M

- Adobe: $3.5M

- Netskope: $9.7M

- ServiceNow: $9.5M

While savings are an important direct metric of success, it should be noted our clients typically realize other indirect cost benefits. Examples include eliminating overbuying risk (which leads to higher overspend long term), structuring deals for greater flexibility and agility, increased software license compliance, and others.

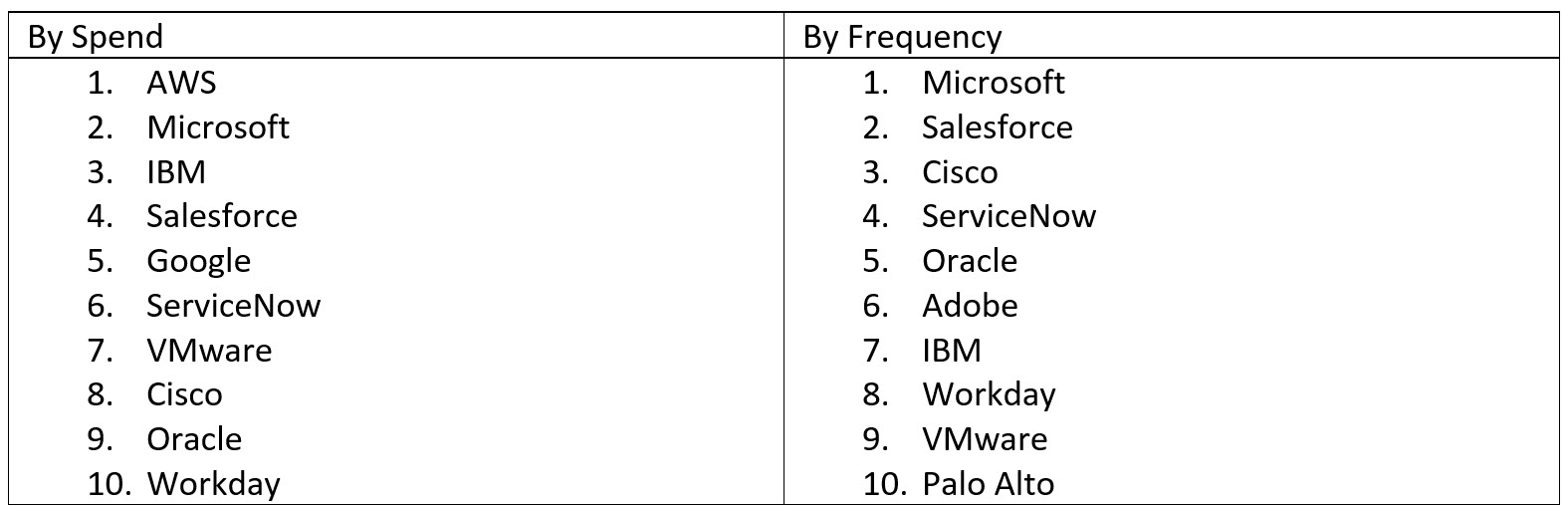

Top 10 Vendors by Spend and Frequency

The top vendors analyzed in 2022 are as follows:

Toxic SaaS Spend and Software License Compliance Risks are Higher than Ever

The risk of software license noncompliance continues to be a massive burden for enterprise IT procurement practitioners. Our software license audit specialists identified compliance issues representing anywhere from $1M to $37M in penalty fees. Our license position assessment and software audit defense services help clients minimize these penalties and remediate risk on their own terms.

On the SaaS front, toxic spend is rampant. An astounding 100% of the SaaS license optimization assessments we performed for our clients revealed material toxic spend. For common enterprise SaaS deployments such as M365, Salesforce, Workday, SuccessFactors and Adobe, we identified savings of anywhere from 6% to 23%. Considering the rate at which these SaaS estates are expanding within the enterprise IT ecosystem, SaaS license optimization represents a huge opportunity for companies to save big in 2023.

Enterprise IT Procurement Advisors Are Making an Impact

The reality of enterprise IT procurement is that it’s impossible to keep up given shifting sands in the economic and vendor landscape. Practitioners need access to real-time vendor pricing, licensing, contracting and negotiation intel that helps them be an expert with every vendor during every purchase transaction. There is no room for overspending or inflexibility in this economic climate. Enterprise IT procurement teams need intel that helps them buy and renew with confidence, accelerate, and simplify the purchase process, and align today’s purchases with current and future-state business requirements.

NPI is proud to be a strategic advisor to the hundreds of enterprises we value as clients and partners (including 112 of the Fortune 500). Our 90% client renewal rate is a testament to the work we do together, and the world-class IT purchasing outcomes we help our clients achieve.

Interested in learning more about NPI’s IT purchase optimization services? Connect with us.

Related Content

- Blog: IT Procurement Strategy: What Types of Intel Do IT Procurement Leaders Need?

- Video: IT Procurement Negotiations – 3 Things Practitioners Can Do to Keep IT Costs in Check

- Video: Managing and Mitigating Inflation-Related Costs

- NPI Service: IT Price Benchmark Analysis & Contract Negotiation Intel