smartspend™ bulletin

How to Negotiate Savings with Verizon Wireless

Enterprises are under pressure to reduce telecom costs. Wireless spend is one element that is notoriously difficult to manage. NPI finds Verizon Wireless enterprise customers often overpay by 15 to 30 percent (or more) because they have not inspected agreements through the lens of the current marketplace, which is highly competitive. But negotiating better pricing, incentives and terms is no easy task. Enterprise customers must come to the table with a strong business case and predefined objectives.

Verizon Wireless continues to be a dominant force among U.S. wireless carriers with a market share of approximately 30 percent. The tight race for the number one spot between Verizon and AT&T shows no signs of abating, even as recent M&A activity (read: T-Mobile and Sprint), shifting customer requirements, and 5G add new contours to the wireless landscape. In response, Verizon has aggressively flexed its competitive and operational muscle in recent years, with net margins double those of AT&T.

While the wireless carrier war wages on, enterprise customers are not necessarily reaping the rewards of the competitive landscape. Enterprise wireless spend management has always been a complex endeavor, but now the complexity and resource requirement is increasing as the frequency of changes to usage plans, contract terms and incentives accelerates. Even the carriers find it difficult to keep up – billing errors are a common occurrence. Between outdated contracts and misaligned service plans, NPI finds most large enterprises are paying much more than they need to for Verizon’s wireless services.

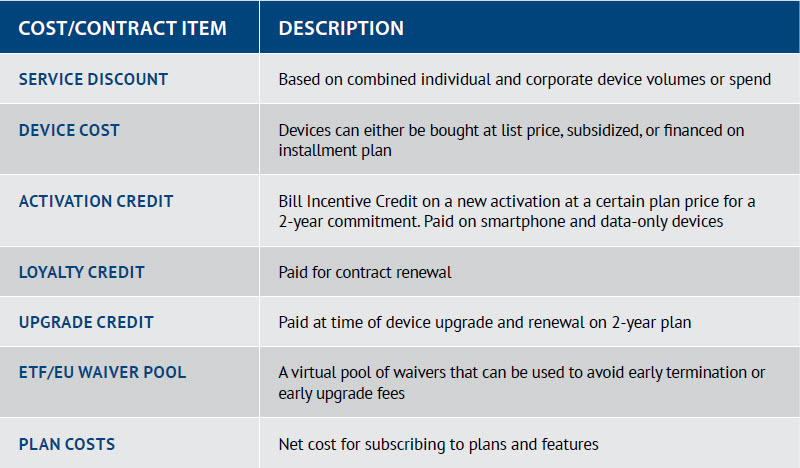

Understanding Key Cost Elements Within Verizon’s Enterprise Customer Agreements

To rein in wireless spend with Verizon, enterprise customers need to inspect their contract and subscription/service choices for savings opportunities. This requires a fundamental understanding of the key cost elements of Verizon’s contracts, which include:

1. Am I paying the best price for the services I am using?

2. Am I getting the best commercial terms, incentives and discounts?

These questions are the cornerstone of carrier contract optimization – a non-disruptive way to achieve material savings on Verizon wireless spend. In NPI’s experience working with clients, savings typically range from 15 to 30 percent, with some outliers achieving 40 percent or more.

Between outdated contracts and misaligned service plans, NPI finds most large enterprises are paying much more than they need to for Verizon’s wireless services.

Preparing for Negotiations

Strong customer-side negotiations with Verizon require diligence and thorough preparation. Before entering negotiations, enterprises should arm themselves with the following information:

FROM YOUR VERIZON ACCOUNT TEAM

- Quarterly business review presentations

- Individual liable (IL) device contributions, including number of devices and spend

- List of upgrade-eligible and out-of-contract subscribers

- Balance and consumption of any ETF/EU waivers

FROM YOUR INTERNAL ANALYTICS

- Consumption – average data consumed by each type of device

- List of upgrade-eligible and out-of -ontract subscribers (to compare to Verizon’s list)

- Any plans for significant near-term changes in business requirements (within the next 6 to 15 months), including device refreshes, project deployments and downsizing

Based on this information, customers should also be aware of where they may/may not have leverage during negotiations with Verizon. While there are numerous ways to maximize buy-side leverage, the most important is new activation potential. Verizon will typically demonstrate greater pricing and contractual flexibility in an account that is projected for substantial growth. The second most important lever is the number of out-of-contract devices. An account with more than 50 percent of devices out of contract has much more leverage than an account with only 10 percent of devices out of contract.

NPI’s clients also arm themselves with price benchmark analysis that quantifies specific cost reduction targets and defines targeted improvements in cost-related business terms that guide the negotiation process.

Verizon Wireless Cost Reduction Best Practice: Focus on Non-disruptive Tactics First

There are numerous ways to reduce wireless spend, but only a handful that deliver meaningful savings without zero business disruption. Out of the four primary ways to achieve wireless savings, enterprises would be wise to focus on the two most high-value/ low-risk tactics as they evaluate and inspect their Verizon spend for savings opportunities:

Carrier Contract Optimization: The optimization of pricing/rates, discounts, credits and business terms. If you haven’t optimized your carrier agreements in the last 18 months, if you have grown significantly, or if you have satisfied your minimal annual revenue commitment (MARC), now is the time to re-optimize your carrier contracts. As mentioned earlier, savings of 15 to 30 percent are typical.

Subscription and Service Optimization: The optimal selection of provider/vendor plans and services based on actual and forecasted usage, and grooming of zero-use lines and services. While some businesses can get away with performing this exercise on a quarterly or semi-annual basis, it’s best done monthly for most enterprises. Savings of 10 to 25 percent are typical.

NPI advises Verizon enterprise customers to get expert assistance with contract optimization and a contemporaneous subscription/service optimization analysis that realigns plans with usage. These important first steps yield the most savings over the longest period of time for the least effort, and position customers well to establish a cadence for ongoing tuning and control of “as is” telecom spend.